Introduction

The volume of purchases and sales of stocks in companies has been a major concern to the investors especially those who study on how to analyze market trends in order to benefit from large stock transactions through what is known as Quant Mutual Fund bulk deals. These deals are significant because they give insights as to how the big boys are positioning themselves in the market place to best advantage; the retail investors can easily determine with this information at their disposal as to where and how to invest. Thus, you can recognize the occurrences of those large bulk moves early enough to notice new trends and prospects in the investment market. In this article, you will find all the details regarding the Quant mutual Fund’s bulk deals analysis, how the processes works, and why you should bother about it.

What Are Quant Mutual Fund Bulk Deals?

Quant Mutual Fund bulk deals are the occasions where the fund buys or sells a large number of shares at a given period within the stock market. They arise when over the single stock trading day, a percentage of more than 0.5% of equity shares in the company are transacted. Such activities attract a lot of attention from the market participants because they point to a high level of demand or supply for stock shares in question. Thus, bulk deals which speak a lot about the fund’s confidence in a particular stock can be considered useful for the individual investors who are looking for direction of the market.

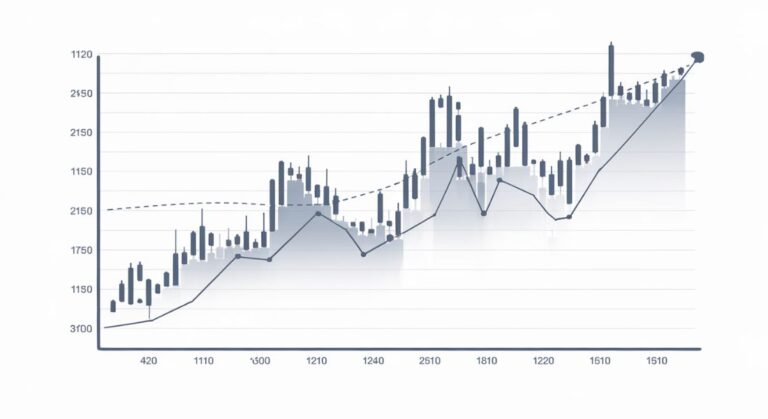

How Do Bulk Deals Affect Stock Prices?

Large quantity trading by Quant Mutual Fund can make a significant difference on the stock of the companies that are traded by the mutual fund. This is because when the fund purchases many shares, this places pressure on the market and results in the price per stock going up. On the other hand, if the fund has to dispose a large quantity of shares, this increases supply and consequently results in the decline of the stock price. Thus, such deals should be tracked in order for investors to know the short-term fluctuation of prices so they can plan well.

Why Are Investors Interested in Quant Mutual Fund Bulk Deals?

Quant Mutual Fund bulk deals are highly important to investors since they reveal the fund’s investment and market trends. Whenever a company like Quant the mutual fond makes big ticket transactions it means the fund is bullish on the sector or company. Through such signals, retail investors follow these signals to find out investment opportunities in the market. This is because when investors know where the fund is investing their money then they will be in a position to know new trends within the market.

How to Track Quant Mutual Fund Bulk Deals Efficiently

Tracking Quant Mutual Fund bulk deals might sound complicated. However, numerous websites offer real-time data. The official websites of the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) provide updates on bulk deals. They also contain a variety of other information. These resources make it easier to stay informed. Moreover, the crucial data about such transactions may be found in financial news portals and applications for market analysis. In this case, you are able to monitor such data closely so as to be in an excellent position to invest appropriately at the right time.

Quant Mutual Fund’s Investment Strategy Behind Bulk Deals

Most of Quant Mutual Fund’s bulk deals contain an investment strategy. This strategy involves finding promising companies that have been underpriced. The fund studies and analyzes these transactions before implementing them. This careful analysis contributes to achieving the fund’s long-term objectives. The strategic approach proves efficient for capitalizing on market opportunities. As a result, it helps deliver returns for investors. Understanding this strategy can benefit ordinary investors. It enables them to follow the portfolio of the fund. By doing so, they can make informed investment decisions. Overall, this strategy enhances transparency and engagement for all investors..

The Risks and Rewards of Following Quant Mutual Fund Bulk Deals

However, it is important to be aware of the risks when tracking Quant Mutual Fund bulk deals. These deals can be quite beneficial. At times, bulk deals can also cause negative impacts. Stock prices may move up after the transaction. In some cases, they may move down. Being mindful of these fluctuations is crucial. Again, you shouldn’t just blindly copy these deals, you are required to do your research on them. That being said, if one is able to dissect these bulk deal categories and study them more closely one can get more insights about the market and definitely get higher return ratios for the investment.

FAQs:

What is a bulk deal in mutual funds?

A bulk deal occurs when a mutual fund buys or sells more than 0.5% of a company’s total equity shares in a single day.

How can I track Quant Mutual Fund bulk deals?

You can track them on the NSE and BSE websites or through financial news portals that provide real-time market data.

Why are bulk deals important for investors?

Bulk deals indicate the fund’s confidence in certain stocks, helping investors identify potential investment opportunities.

Do bulk deals always lead to stock price changes?

Yes, bulk deals can affect stock prices, but the impact varies depending on market conditions and investor sentiment.

Is it safe to follow Quant Mutual Fund bulk deals for investing?

While they provide valuable insights, it’s important to conduct your own research and not rely solely on these deals for investment decisions.